Traditional fraud detection tools

aren’t cutting it.

The evolving landscape of scams and social engineering tactics has made individuals more susceptible than ever. Our goal is clear: to usher in a new era where fighting fraud is no longer one-time glimpse into the past but a constant monitoring of the now.

From scams to mules, ThreatMark can help.

In this world of constantly increasing fraud threats, we’ve reimagined protection. We’ve created the means of disrupting the fraudsters’ infrastructure. Our platform that not only mitigates scams, phishing, and unauthorized access, it interrupts fraud operations across all stages of the attack. We help stop fraud before it happens.

-

Scams & Social Engineering

Deceptive schemes or tricks aimed at obtaining money or sensitive information from an individual.

-

Phishing Detection & Mitigation

Techniques used by fraudsters to manipulate individuals into divulging confidential information.

-

Account Takeover

Unauthorized access and control of a user's account by a malicious actor, often resulting in fraud.

-

New Account Fraud

New account fraud typically occurs when imposters use stolen or fake identities to open accounts.

-

Money Mules

Accounts that provide a mechanism to cash out fraudulent transactions or hide the digital tracks of fraud.

-

Transaction Risk Analysis

Adaptive application of applying stringent security measures for risky transactions, balancing security and UX.

Winning the war against scams and social engineering.

48% of financial institutions executives see scams and social engineering as the greatest modern threat. Traditional fraud detection methods are therefore ineffective as fraudsters now commonly avoid direct interaction with banking platforms, preferring to manipulate victims directly. Winning the war against scams and social engineering requires arming organizations with the right tools at the right time.

ThreatMark’s Solutions

Enhance your defenses against phishing.

Phishing is the primary catalyst for over 90% of cyber attacks. Real-time detection and mitigation is crucial to limiting fraudsters’ opportunity to harvest sensitive data, safeguard digital interactions and preventing the misuse of stolen credentials.

Phishing Detection & Mitigation

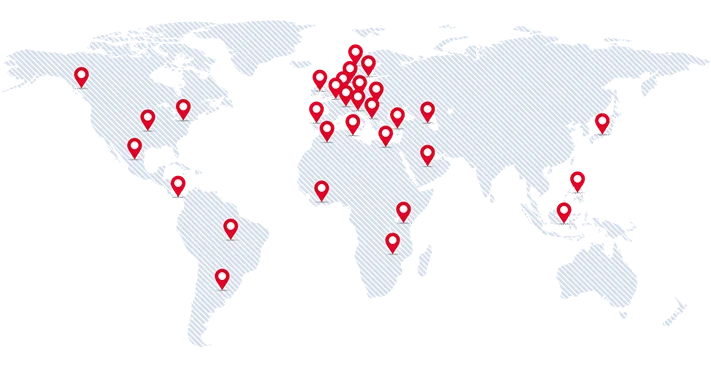

40+ million online users protected.

ThreatMark’s Cyber Fraud Fusion Center stands at the forefront of fighting cyber threats, such as phishing and malware, with its expertise, tools, and intelligence.

Revolutionizing fraud prevention.

Our Behavioral Intelligence Platform is the world’s first full-stack fraud prevention platform built on behavior intelligence. Combining transaction risk analysis, threat detection, and user behavior profiling capabilities in one integrated platform.

Minimize fraud and credit risks

Apply AI-based anomaly detection software to identify advanced fraud threats, minimize fraud that employ social engineering, phishing, malware, and zero-day attacks.

Distinguish legitimate users

Verify user identity, expose fraudulent signups and prevent other malicious online activities with real time monitoring.

Strike a balance

Add a layer of invisible protection to existing authentication systems, protecting users without the hassle and cost of two-factor authentication.

Enhanced Customer Experience

Improve customer experience by minimizing unnecessary interruptions and provide a seamless and secure banking experience.

-

ThreatMark Launches ScamFlag, a GenAI-Powered Solution to Combat the $486 Billion Digital Fraud Crisis

ThreatMark launches ScamFlag, a revolutionary Generative AI-powered solution designed to protect digital banks and their customers from the growing epidemic of scams.

Read More

-

Scam-Proofing The Future: A Whitepaper

Scams are becoming more sophisticated, posing new challenges for financial institutions. Explore the whitepaper for an in-depth look at the evolving scam landscape including real-world impacts.

Download Now