Why Threatmark

We’re flipping the script on fraud prevention.

Advanced, contextual fraud prevention to interrupt fraud operations at every stage of the attack.

-

2015year founded.

-

100+team members.

-

9000+phishing sites mitigated annually.

-

40M+online users protected

AI-powered solution disrupting

digital banking fraud.

Harnessing cutting-edge AI methodologies, ThreatMark is revolutionizing the landscape of digital banking fraud prevention. Through real-time monitoring, ThreatMark effectively tracks malicious activities across all stages of an attack, spanning the entirety of the fraud ecosystem.

By meticulously gathering data from diverse digital channels, ThreatMark proactively disrupts fraudulent schemes, empowering businesses to prioritize user experience enhancement for genuine customers.

Compliance is pushing the fraud

prevention market growth.

Scams and fraud scheme losses totaled $485.6 Billion in 2023, but less than 10% of it actually represented bank losses. However, a recent compliance-driven shift in liability has resulted in a higher demand for scam prevention solutions.

Overwhelmed internal fraud teams, more false positives, customers potentially losing their life savings, and the banks’ obligation to reimburse victims of APP fraud are just a few of the challenges financial institutions face in their fight against fraud.

ThreatMark approach to

fraud prevention.

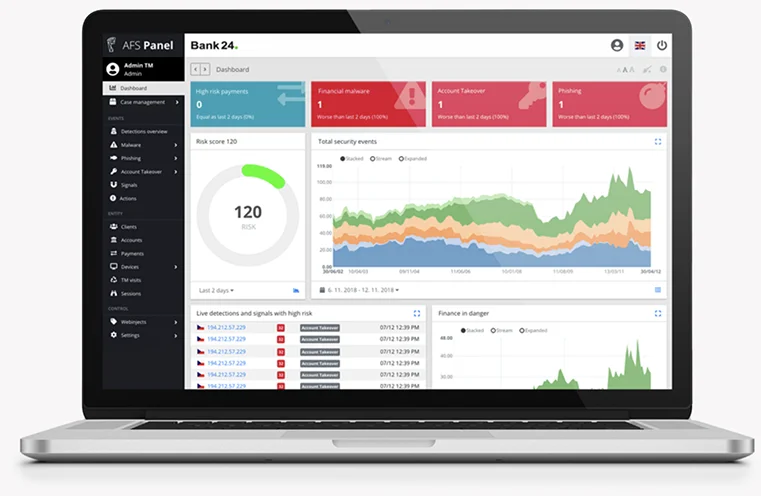

ThreatMark’s unique Fraud Disruption Solution refocuses fraud professionals on identifying fraudulent users, not genuine ones, interrupting fraud operations across all stages of the attack.

- Collect intel.

- Analyse their tactics.

- Deplete their resources.

- Identify & prevent future fraud.

Revolutionizing fraud prevention.

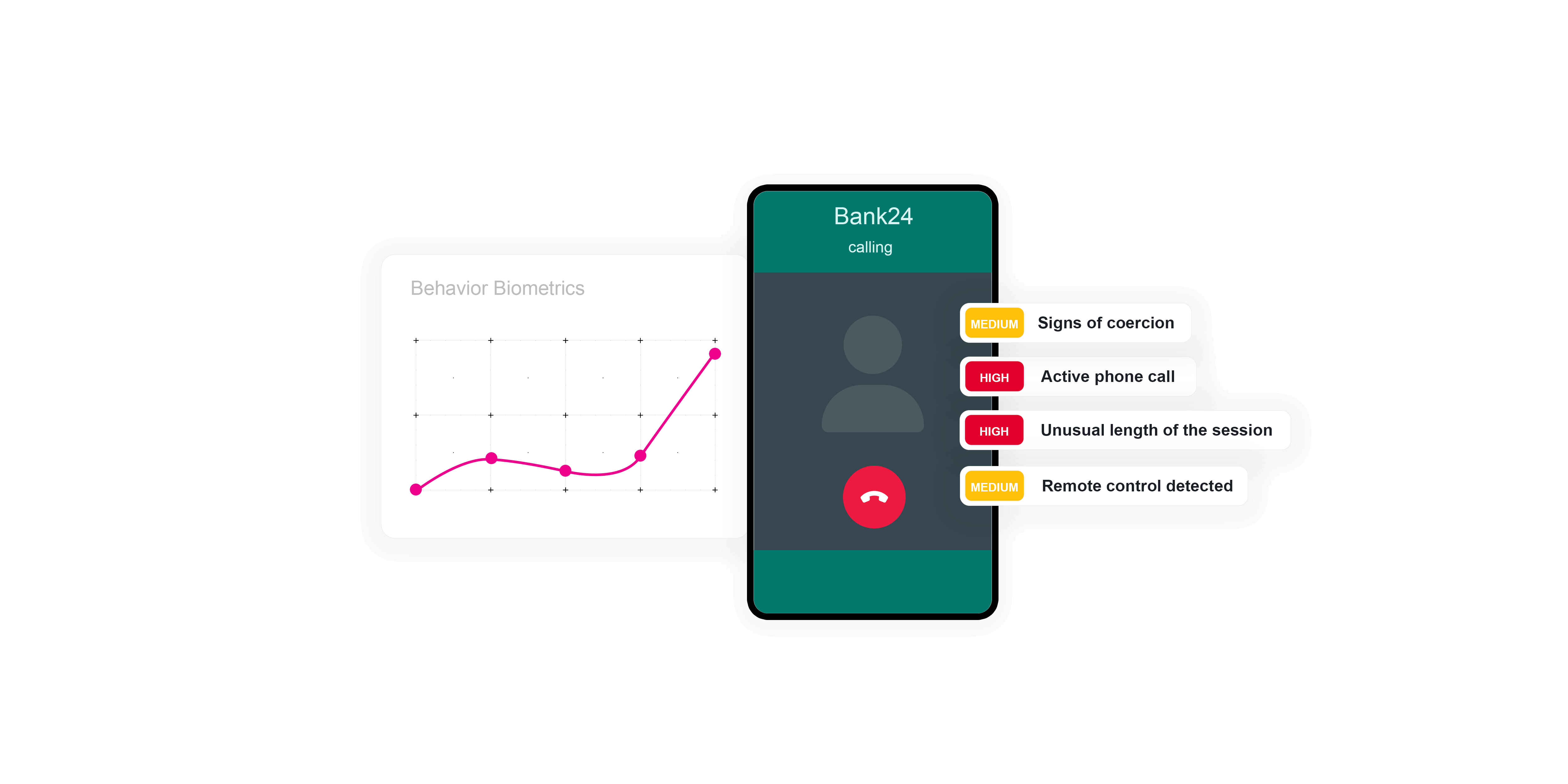

Our Behavioral Intelligence Platform is the world’s first full-stack fraud prevention platform built on behavior intelligence. Combining transaction risk analysis, threat detection, and user behavior profiling capabilities in one integrated platform.

learn More

40+ million online users protected.

ThreatMark’s Cyber Fraud Fusion Center stands at the forefront of fighting cyber threats, such as phishing and malware, with its expertise, tools, and intelligence.

Cyber Fraud Fusion Centre

Our investors

Join Us

Explore open opportunities to become a ThreatMark Fraud Fighter and join us in disrupting fraud.