Romance Scams

In romance scams, individuals are misled into sending money to someone they’ve met online, often on dating sites or social networks, believing they are in a romantic relationship.

The scam starts with the creation of a fake online persona by the scammer, who then carefully builds a connection with the victim. This relationship is nurtured, sometimes for months, to establish trust. Once trust is established, the scammer invents an emergency, such as needing money for medical bills, travel costs, or legal issues, and asks the victim for financial help.

Data from UK Finance shows that victims of these scams typically make more than eight transactions in each case, indicating that victims are repeatedly persuaded to send smaller amounts over time to the perpetrator. This pattern underscores the manipulative nature of the scam, where the victim is gradually entangled in the scammer’s web of deceit.

TALK TO A FRAUD FIGHTER

The impact of romance scams.

-

50%annual increase in reported cases of romance scams.

-

100M+dollars collectively lost each year to victims of romance scams.

-

60%of reported victims are middle-aged individuals between 40 and 69 years old.

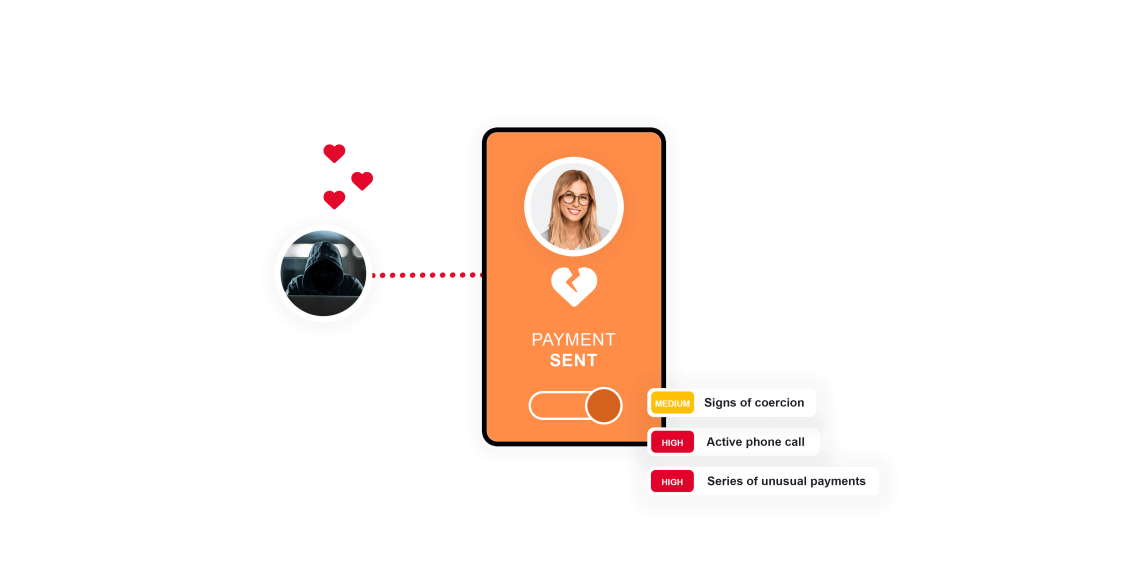

Proactive monitoring can help stop romance scams.

ThreatMark can play a crucial role in helping financial institutions prevent romance scams. By analyzing a customer’s usual transaction behavior, it can detect unusual patterns that may indicate a scam, such as an increase in frequency or number of payments to a new recipient. These deviations from the norm, especially when coupled with transactions that align with common scenarios in Romance Scams (like sending money for emergencies), can trigger predictions that fraud is occurring. The system’s real-time monitoring capabilities allow for immediate action, such as flagging suspicious transactions for review.

Furthermore, by aggregating data over time, ThreatMark can identify the gradual increase in transaction frequency and amount, a hallmark of Romance Scams. It can recognize when a customer starts making multiple smaller payments, consistent with the scam’s progression. This insight allows financial institutions to proactively intervene, possibly reaching out to the customer to confirm the legitimacy of these transactions. In this way, behavioral intelligence serves as an effective tool in the fight against the manipulative tactics of Romance Scams, enhancing the overall security of customer funds.

Mitigating romance scams.

Techniques to Stop Romance Scams

-

Abnormal Payment

The amount of a payment, the time of day or day of the month it was sent, and the beneficiary of the payment can all be analyzed for risk to uncover if the payment is abnormal. By looking at the context of the payment in combination with other risk indicators can lead to the prevention of fraudulent payments.

-

Mobile Phone Call Active

Scams and social engineering exploit the weakest link in the security chain, and that is the customer. Scammers use coercion to manipulate the victim into doing something against their best interest, including moving money. One technique scammers use is calling the victim on their mobile device and talk them through the money movement process. An active call during a banking session can be an indicator of a scam in progress.

-

Mobile Biometry Anomaly

Mobile behavioral biometry is continuous user verification. Each user has a unique pattern of how he holds his phone, operates it, and makes touch gestures. Based on this pattern we can tell if current visit data matches previously observed patterns obtained during previous visits.

Want to learn more about ThreatMark?

Complete our form to discover more about ThreatMark’s comprehensive approach to fraud disruption.