Bonus Abuse

Bonus abuse involves manipulating offers designed for new customers.

Individuals or organized groups fraudulently use referral codes to amass bonuses or discounts by creating fake accounts or using others’ information without consent. This leads to losses for financial organizations and undermines reputable promotional campaigns.

Such abuse strains resources, necessitating improved fraud detection systems, and may impact genuine customers through stricter promotional policies. While not directly stealing funds, this fraud significantly affects the institution’s marketing and customer relations, posing a challenge to maintaining the integrity of promotional activities.

TALK TO A FRAUD FIGHTER

The impact of bonus abuse.

-

50%all fraud cases in the gambling sector are bonus abuse.

-

7.6%fraud rates in gaming in 2023.

-

15%of annual gross revenue is lost due to bonus or promo abuse fraud.

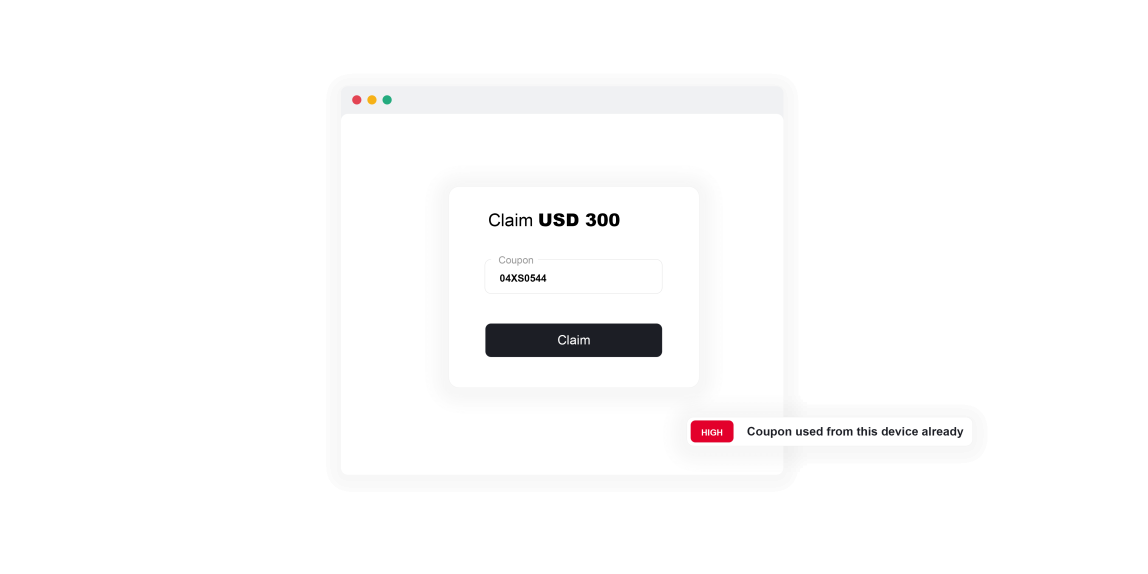

Catch bonus abuse and stop it.

ThreatMark effectively identifies and prevents referral bonus or promo code abuse in financial institutions by analyzing patterns in account creation and usage, and detecting anomalies that could indicate fraudulent activity. For instance, a high volume of accounts created from the same device, IP address, or accounts exhibiting similar transaction behaviors can signal the mass creation of fake accounts for bonus abuse. Additionally, the system can flag accounts that show irregular activity patterns typically associated with promo code exploitation, such as immediate and sole usage of codes without regular customer activity. By recognizing these patterns, the system enables the institution to take action, like invalidating fraudulent accounts and their transactions, thereby protecting the integrity of its promotional campaigns.

ThreatMark’s behavioral intelligence assists in differentiating between genuine customer behavior and fraudulent exploitation of promotional offers. This distinction is crucial to ensure that legitimate customers are not unfairly impacted by tighter promotional policies developed in response to fraud. By accurately identifying and targeting only fraudulent activities, financial institutions can maintain customer trust and the effectiveness of their marketing strategies while safeguarding against financial losses and reputational damage caused by promo code abuse.

Mitigating bonus abuse.

Understanding bonus abuse.

-

Device Intelligence

Device Intelligence uses an extended set of different device features and context information extracted from the browser, device OS, hardware properties of different device subsystems, network information, and other data sources to identify the physical device accurately. ThreatMark employs deep behavioral profiling to tell whether the currently visiting devices are associated with legitimate users or fraudsters or have never been seen before.

-

Behavioral Intelligence

ThreatMark Platform captures the exact details of the user's interaction with the interface of an application and analyzes the person's cognitive and behavioral traits. Using primary data the ThreatMark Platform collects during user activity, it employs state-of-the-art machine learning methods to identify historically observed legitimate and criminal behavior patterns.

Want to learn more about ThreatMark?

Complete our form to discover more about ThreatMark’s comprehensive approach to fraud disruption.