Instant Payment Scams

Instant payment scams exploit the speed and convenience of electronic transactions.

Preying on individuals’ trust and the immediacy of online transactions, perpetrators use deceptive techniques to manipulate victims into making immediate payments under false pretenses. The widespread global adoption of instant payment methods has provided fertile ground.

TALK TO A FRAUD FIGHTER

The impact of instant payment fraud.

-

63%year-over-year increase of real-time payment transactions, in 2022.

-

68%increase in instant payment fraud year-over-year.

-

12Mof the €20 million in losses due to transfer fraud between 2020 and 2021 came from instant payments.

Spot instant payment scams in real-time.

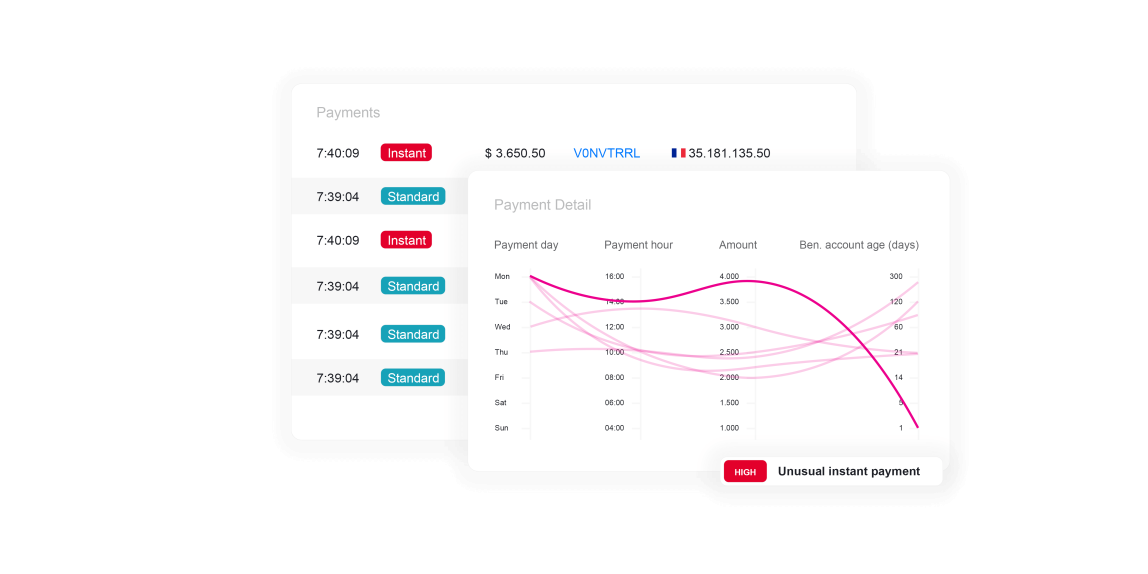

Behavioral intelligence is vital in combating instant payment scams by analyzing transaction patterns to detect anomalies. This technology enables real-time monitoring, flagging suspicious activities like unusual transaction amounts or frequencies.

By understanding typical customer behaviors, such as login times and transaction types, the system can spot deviations that may indicate coercion or fraud. This approach relies on predictive analysis, uncovering potential new scam trends and methods, which is impossible with traditional transaction monitoring.

ThreatMark’s unique behavioral technique and other security measures like behavioral biometric verification create a comprehensive defense against instant payment scams. This dynamic strategy helps protect customers more effectively.

Understanding instant payment fraud.

-

Instant Payment Risk Scoring

During vishing attacks, fraudsters employ evasive strategies to avoid detection, ensuring they can finish the transaction before being blocked. One of these strategies is to use high-priority transactions like instant or express payments. One way to block these fraudulent transactions is to scrutinize the priority attribute of a payment.

-

Mobile Phone Call Active

Scams and social engineering fraud exploit the weakest link in the security chain, and that is the customer. Scammers use coercion to manipulate the victim into doing something against their best interest, including moving money. One technique scammers use is calling the victim on their mobile device and talking them through the money movement process. An active call during a banking session can indicate a scam in progress.

-

Abnormal Payment

The payment amount, time of day or day of the month of transfer, and the beneficiary can all be analyzed for risk to uncover if the payment is abnormal. Looking at the context of the payment in combination with other risk indicators can prevent fraudulent payments.

Want to learn more about ThreatMark?

Complete our form to discover more about ThreatMark’s comprehensive approach to fraud disruption.