Session Hijacking

During session hijacking, a threat arises when a customer’s active session with the financial institution’s digital platform is stolen.

This can happen in several ways, including “sidejacking”, where attackers intercept and take control of a user’s session token or cookie. Once the attacker gains control of the session, they can conduct unauthorized transactions, alter account settings, or steal sensitive financial information whilst pretending to be the legitimate user. The customer remains unaware of the unauthorized access until the damage has been done.

TALK TO A FRAUD FIGHTER

-

22Bdevice and session cookies in 2022.

-

15%of phishing attacks use adversary-in-the-middle (AiTM) to hijack sessions.

-

20%of ATO is the result of session hijacking.

Tackle session highjacking threats.

Session stealing poses a severe risk, as it compromises the security of the online banking session and the integrity of the customer’s financial data, leading to potential financial losses and erosion of trust in the institution’s digital security measures.

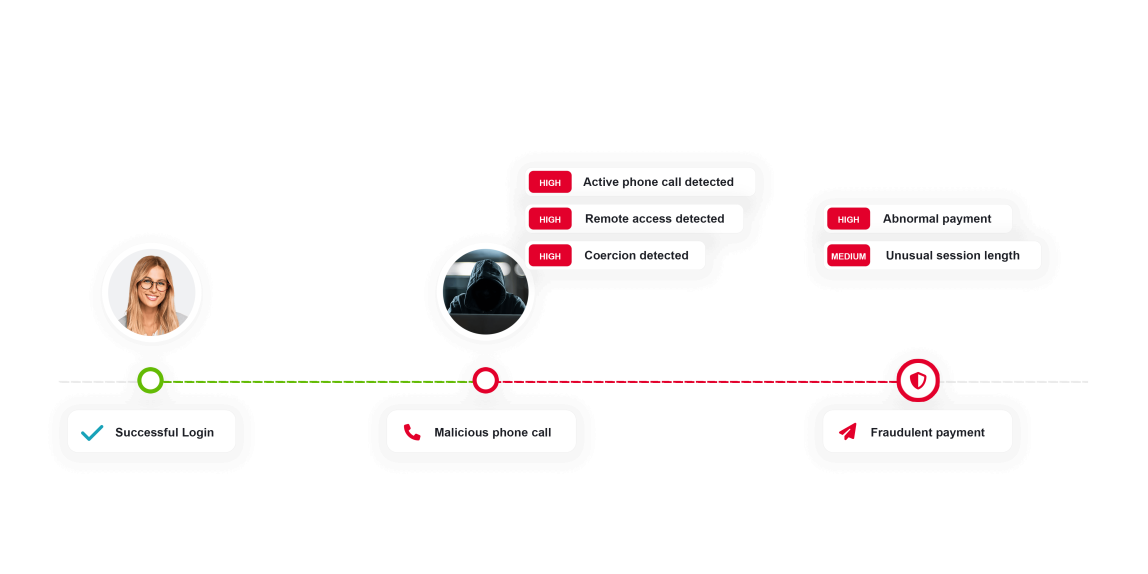

ThreatMark can be instrumental for financial institutions in preventing session hijacking. By monitoring patterns in user behavior and session characteristics, ThreatMark detects anomalies that suggest a session has been compromised. For instance, it can identify irregular transaction patterns, unexpected changes in account settings, or the sudden switch of a user’s device or location during an active session. These irregularities are scored and flagged, enabling the financial institution to respond quickly, halt suspicious transactions, or terminate the compromised session to prevent further unauthorized activities.

ThreatMark’s ability to analyze a variety of data points, including device and network, enhances its effectiveness in identifying session hijacking threats. This proactive approach, for example, flag sessions initiated from unsecured networks or devices with unusual security configurations, not only helps mitigate the immediate risks of session hijacking but also contributes to strengthening overall digital security measures. It ensures the protection of sensitive financial information and maintains customer trust in the institution’s digital platforms.

Mitigating session stealing.

Detecting session hijacking.

-

Anomalous in-app navigations & actions

ThreatMark monitors in-app user actions and employs machine learning and AI-powered methods to compare insights with behavioral profiles. Any unexpected activities are flagged, enabling financial institutions to respond promptly.

-

Behavioral biometrics mismatch

Through the collection of data from device, mouse, and keyboard sensors, every user's unique behavioral biometrics profile is formed. Using such data, ThreatMark Platform can successfully identify two different users operating on the same device based on how the device is operated.

-

Anomalous sessions parameters

With ThreatMark's deep behavioral profiling of current and historical IP data, session inspection including session length, and typical geolocation, visibility over the entire user digital journey significantly improves. As irregular patterns are flagged as atypical during a session hijacking, real time notifications enable financial institutions to respond quickly, halt suspicious transactions, or terminate the compromised sessions.

Want to learn more about ThreatMark?

Complete our form to discover more about ThreatMark’s comprehensive approach to fraud disruption.