Bot Attacks

Bots, or automated software programs, are challenging to defend against in many digital environments.

Fraudsters commonly use bots to carry out their attacks due to their ability to automate repetitive actions at scale, with cybercriminals deploying armies of bots to perform various tasks, from spreading malware and phishing to launching large-scale attacks. Bots can be uploaded to devices with relative ease and work at immense speeds. With the introduction of AI, Bots can also imitate human behavior. The scale of bot attacks makes them a significant risk to individuals and, ultimately, the financial institutions attempting to mitigate them; therefore, mitigating and safeguarding digital ecosystems is a priority.

TALK TO A FRAUD FIGHTER

The impact of bot attacks.

-

102%year over year increase in bad bot traffic.

-

73%of all website and app traffic measured bots comprised.

-

123%rise in ATO attacks involving bots in the second half of 2022.

Proactively stop bot fraud.

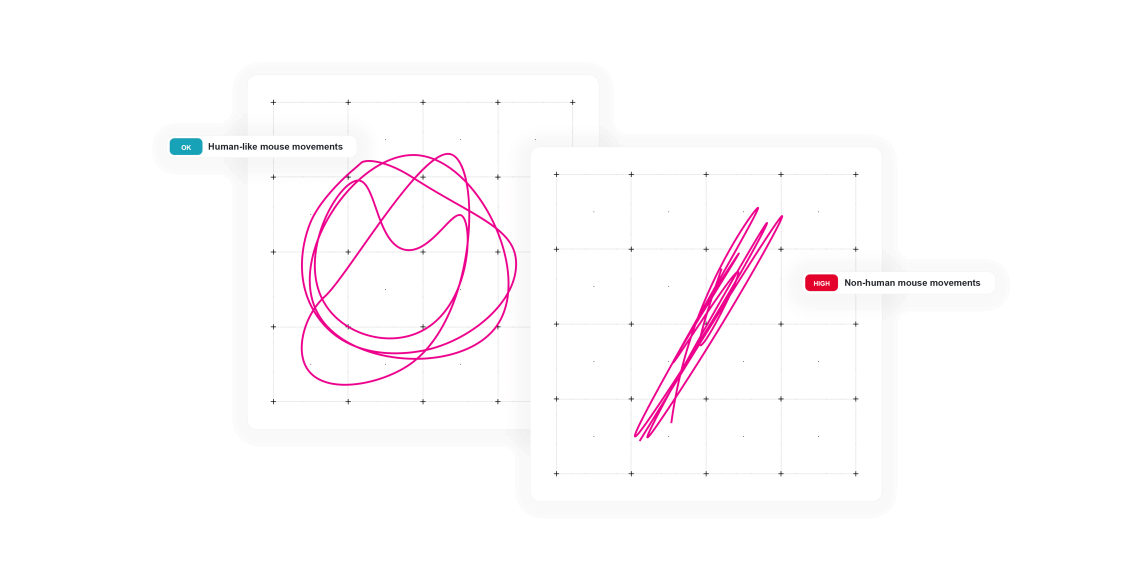

ThreatMark provides a comprehensive approach to preventing bot attacks, implementing cutting-edge AI and ML-driven behavioral profiling and intelligence to safeguard financial institutions from bots and automated action attacks. Understanding bot attacks is crucial for the prevention of bot financial fraud. Despite the remarkable speed and volume at which automated bots can execute tasks, ThreatMark’s Behavior Intelligence Platform harnesses behavior analytics, effectively identifying the specific differences between bot and human behavior.

Beyond the financial loss that bot attacks pose, financial institutions are also at risk of reputational damage and potential legal complications. Our platform comprehensively assesses the contextual factors surrounding every new account creation, ensuring a proactive defense beyond traditional credential and device mitigation methods.

Mitigating bot attacks.

-

Behavioral Biometrics

Swift sequential mouse movements, numerous clicks per second, an absurd typing speed—the ThreatMark Platform meticulously records every action. Fast sequential mouse movements, so many clicks per second, ridiculous typing speed; what else can you think about? ThreatMark Platform records every action, profiling each action as human or bot through behavioral intelligence.

-

Credential Stuffing

ThreatMark's Platform monitors the entire digital journey of a user from the pre-login phase. This is how ThreatMark can easily detect fraudsters who try to login repeatedly with incorrect credentials using automated means.

Want to learn more about ThreatMark?

Complete our form to discover more about ThreatMark’s comprehensive approach to fraud disruption.