Money Mules

Money mule accounts play a critical role in the world of fraud.

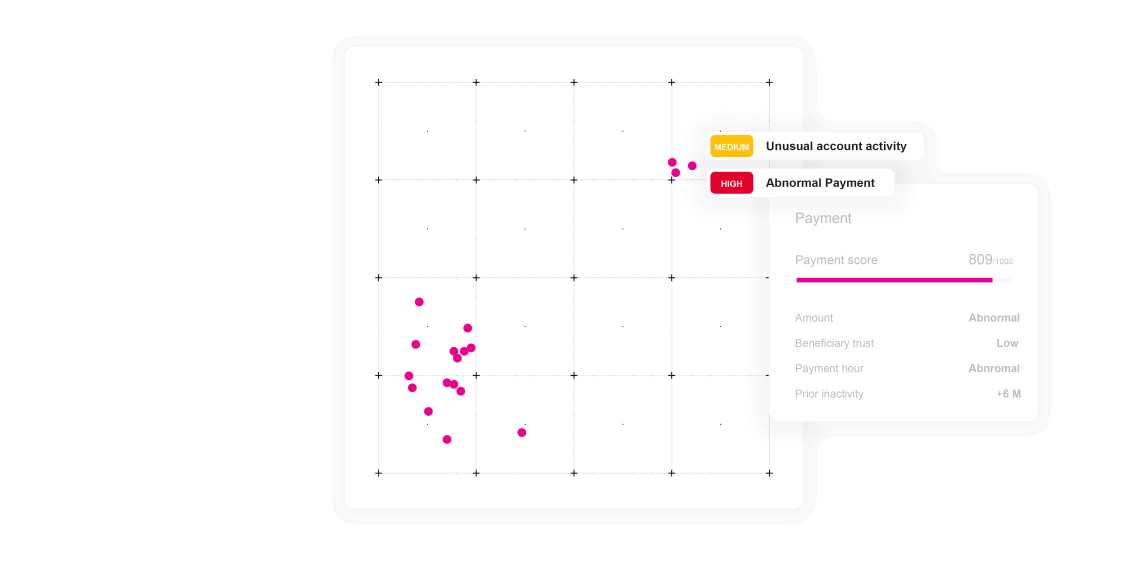

The behavior of each money mule account is distinct and not easily detectable, enabling criminals to launder money and carry out fraudulent transactions easily. ThreatMark analyzes subtle behavior specificities to reliably spot the money mule during account creation and suspicious interactions within existing accounts.

Identify money mule accounts before they can be used to siphon money from your customers.

TALK TO A FRAUD FIGHTER

Money mules are accounts that play a role in the fraud supply chain infrastructure. Providing a mechanism to cash out fraudulent transactions or hide the digital tracks of fraud, these accounts anonymize stolen money, making it difficult to trace and protecting fraudsters from law enforcement and authorities. Among fraudsters’ favorite methods is exchanging money for cryptocurrency or sending money to a money transfer service. Tracing the flow of money is challenging for authorities in both cases, and for financial institutions, this represents a critical problem that may result in severe fines.

Money mule accounts are hard to detect since their activity varies based on their level of participation, from intentional misuse to being indirectly complicit. Traditional transaction monitoring and AML solutions often identify mules only after the money is gone, missing critical moments during the account creation and interactions.

ThreatMark’s Behavioral Intelligence Platform employs preventative measures based on deep behavioral analysis to fight money mules, changing the paradigm of retroactive payment analysis.

The impact of money mules.

-

73%of money mule onboarding is done from devices that have recently onboarded other accounts.

-

50%of money mule onboarding processes have signs of automation such as copy-pasting and missing mouse movements.

-

79%of money mule accounts became more active just before receiving the first batch of fraudulent incoming payments.

Mitigating modern money muling.

Understanding money muling.

-

Bot Attacks

Fraudsters frequently leverage bots for their attacks, benefiting from their capacity to automate repetitive actions on a large scale. Bots are no longer simply clicking tools but sophisticated applications capable of masking their activity and effectively bypassing security measures.

Learn More

-

Loan Fraud

Fraudsters try to obtain financial advantage by submitting online forms that appear to be legitimate. They provide fake documents, use fabricated data, and create synthetic identities. Once their loan is approved, they disappear with the funds, leaving the financial institutions with a substantial economic loss. Lending fraud is a significant challenge for financial institutions as it undermines trust in their services.

Learn More

-

Bonus Abuse

Bonus code abuse is when scammers try to cheat incentives meant for new customers. These people, either alone or in groups, use unfair means to take advantage of referral codes, such as creating false accounts or using someone else's personal information. This behavior results in financial losses for financial institutions and destroys marketing efforts.

Learn More

FAQ: Money Mules

-

Why is traditional transaction monitoring not effective against money muling?

The nature of money mules accounts is (usually) unsuspecting individuals being manipulated into believing a fraudsters’ cover story. Traditional transaction monitoring is therefore uneffective, understanding these transactions to be genuine.

-

How does the ThreatMark solution differ?

ThreatMark’s Behavioral Intelligence Platform is AI-powered deep behavioral analysis, producing a behavioral profile on how users typically interact with digital platforms. This approach protects banks against money mule activity from account onboarding to banking application interaction, changing the paradigm of retroactive payment analysis.

Insights gathered during account interaction can supplement onboarding info.

-

79%

of money mule accounts became more active just before receiving the first batch of fraudulent incoming payments.

-

60%

longer, on average, are sessions with transactions from money mule accounts compared to those that are legitimate.

-

65%

of money mule accounts showed inactivity for extended periods, before fraudulent money transfers.

-

91%

of fraudulent transactions from money mules are distributed into smaller payments to various accounts.

-

Don’t Take The Bait

In an effort to keep our customers up to speed on the latest trends when it comes to threat detection and fraud prevention, ThreatMark presents our phishing blog series: Don’t Take the Bait!

Read More

-

Security Issues Threat Actors Can Exploit In The Metaverse And How To Prevent Them

Digital identity theft is a major security concern in the online world today. With Metaverse being predicted to be the next phase of the internet and social interaction, such threats will continue with virtual profiles in the new realm, too. Solutions like ThreatMark are the perfect antidote to these security issues.

Read More

Want to learn more about ThreatMark?

Complete our form to discover more about ThreatMark’s comprehensive approach to fraud disruption.