Smart Friction: How Adding the Right Kind of Friction Protects Users from Scams

In a fraud landscape dominated by social engineering and manipulation, a frictionless experience becomes a double-edged sword.

For more than a decade, digital innovation has been guided by a single mantra: remove friction. Onboarding had to be instant, payments one-click, authentication invisible.

This obsession with convenience shaped today’s digital world—yet it has quietly opened the door to a new vulnerability. As financial institutions strengthen their systems, fraudsters are shifting their focus from machines to minds. Investment fraud, impersonation, romance scams, remote-access coercion, and other types of modern scams don’t exploit technical flaws. They exploit human behavior through persuasion, pressure, and manufactured trust.

Across the industry, one realization is becoming clear: Friction, when applied intelligently, protects.

The Evolution of Friction

Not all friction is created equal. What began as basic interruptions has evolved into adaptive, intelligence-driven mechanisms that can engage users in real time.

Today, friction spans a spectrum, from simple prompts to advanced, context-aware interventions that actively counter manipulation.

A helpful way to understand this progression is through three maturity levels.

1. Basic Friction: “Pause Before You Pay”

The simplest form of protection relies on a deliberate pause, a moment designed to interrupt the user’s flow and prompt a second thought.

- Generic confirmation prompts (“Are you sure you know the recipient?”)

- Simple heuristics such as new payees, unusually large amounts, or foreign account.

Goal: Awareness. This type of friction gives users a chance to reconsider before completing an irreversible action.

Limitation: When a warning appears once too often and lacks a personal touch or clear context, it stops doing its job. Users start to ignore it and move on automatically, which is how “warning fatigue” takes hold.

2. Contextual Friction: “This Is Not Your Usual Behavior”

The next stage of friction is targeted and data-driven. It appears only when the situation calls for it, which makes it far more credible and dramatically more effective.

Mechanism:

- Behavioral intelligence. Subtle anomalies in typing rhythm, hesitation, cursor movement, or even device orientation can signal that the user is under pressure or being guided by someone else.

- Transactional intelligence. Transactional Monitoring spots patterns that closely mirror known scam scenarios, such as repeated high-value transfers to newly added “investment” accounts or large payments that immediately follow an unsolicited call.

- Dynamic messaging. Instead of generic alerts, users receive relevant guidance. If behavior aligns with an investment scam pattern, they may see a tailored explanation or a short educational video on how to recognize fraudulent from legitimate brokers.

- Environmental triggers. Some systems monitor the user’s environment for high-risk situations, such as ongoing phone calls, screen-sharing, or remote-access activity.

Goal: Precision. Only a tiny fraction of transactions ever trigger this type of intervention, but when it does appear, it feels timely, personal, and difficult to dismiss.

Limitation: Contextual friction is highly effective but sensitive to miscalibration. Unusual yet legitimate behavior or overly intrusive messaging can reduce its impact and cause users to tune it out.

3. Intelligent Friction: “Here’s How to See Through the Manipulation”

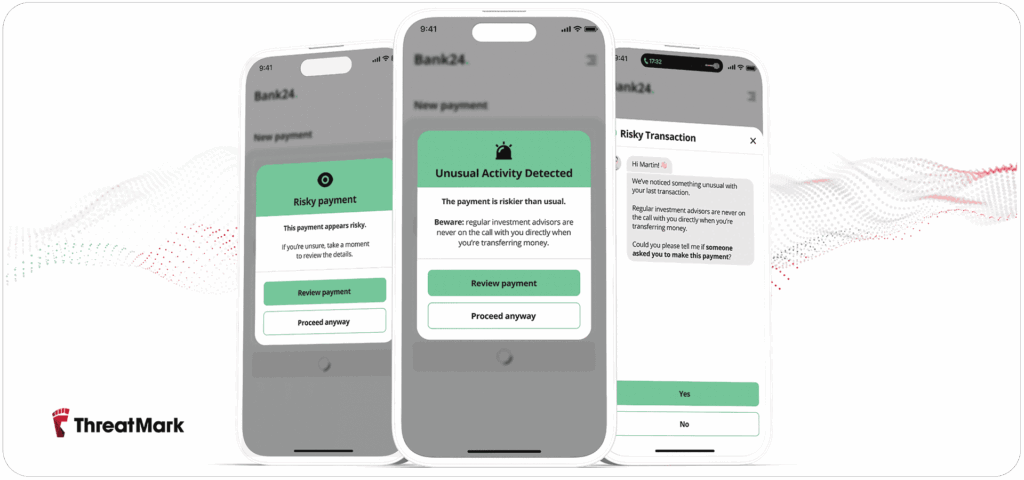

At this stage, friction stops feeling like security and starts acting like interactive support. Rather than issuing a warning and stepping back, it behaves like a personal fraud bodyguard: responsive, attentive, and ready to help the user push back against manipulation in real time.

Mechanism:

- AI-assisted conversation. Advanced models can pick up linguistic cues such as urgency, authority, fear, or compliance pressure and respond instantly.

- Multimodal input. Users can upload screenshots of chat conversations, social media ads, emails, or suspicious websites. The system analyzes them using behavioral intelligence and language models to assess the likelihood of a scam.

- Dynamic dialogue. Instead of a static pop-up, the system engages the user in a natural exchange. For example: “This message resembles a known investment scam. Would you like to see how these scams typically work?”

- Continuous learning. With every confirmed case, the system becomes more accurate, expanding its understanding of new scam typologies.

Goal: Active de-manipulation. This level of friction does more than delay a scam. It helps the user break through manipulation and regain their critical thinking—not just in the moment, but in future encounters as well, building long-term resilience and deepening their trust in the financial institution.

Limitation: Interactive AI guidance must be explainable and compliant, especially in regions like the EU. Auditable logic is important for risk teams and regulators.

The Data Backbone: What Makes Smart Friction Possible

Smart friction only works when it understands the person behind the screen. From simple prompts to real-time de-manipulation, every level of friction depends on the same thing: high-quality, real-time insight into what the user is doing and why.

Without that insight, friction turns into noise—and worse, into false positives that interrupt legitimate activity and frustrate users.

With it, friction becomes one of the most precise tools a bank can use.

Behavioral Intelligence

People interact with their banking app in consistent ways: the pace of their typing, their mouse dynamics, the way they scroll, where they pause. Over time, this becomes a clear picture of what “normal” looks like for them. When that rhythm suddenly changes, movements become hesitant or patterns look unfamiliar, it signals that something may be wrong. These small shifts often appear when a user is confused, under pressure, or being coached by someone else.

Device Profiling

Devices carry their own set of signals. They reveal whether a login originates from an unusual location, whether the network environment is trustworthy, or whether remote-access or screen-sharing tools are in use. When combined with behavioral data, device intelligence helps distinguish routine activity from the early signs of manipulation.

Transactional and Contextual Enrichment

On top of behavior and device data, transactional context adds another layer: new payees, unusual amounts, rapid-fire transfers, or payments that don’t fit the user’s usual spending patterns.

When these signals are combined, the system can read the situation with remarkable accuracy, knowing when to pause a risky action, how strongly to intervene, and what message to deliver.

This is the foundation of smart friction: protection that appears only when it should, says only what matters, and delivers impact without adding noise.

Learn more about behavioral intelligence

The Next Frontier: From Smart Friction to Active Assistance

Most banks and fintechs today operate somewhere between basic and contextual friction. These layers already offer meaningful protection, but the landscape is shifting. As AI becomes foundational in digital banking, a third layer in the form of interactive, AI-assisted protection is emerging as the next major opportunity to reduce scam losses.

This is where solutions like ScamFlag, an AI-powered tool for scam recognition embedded directly into the banking app, mark a genuine step forward.

Instead of simply issuing alerts, ScamFlag functions as an active assistant that meets the user in the middle of a scam attempt. It can interpret user context, analyze screenshots or website links, and engage in a natural conversation that helps the user understand what is happening.

Imagine someone receiving an “investment opportunity” through a messaging app—a scam that cost US consumers $5.7 billion in 2024, more than any other scam category.

- They upload the screenshot to ScamFlag.

- The system evaluates the language, links, and visual markers using behavioral and contextual intelligence.

- The AI responds with a clear explanation: “This message shows several indicators of a known investment scam: guaranteed returns, urgency, and payment requests to personal accounts. Legitimate advisors never use these tactics.”

This approach moves beyond general warnings to advice that is specific, contextual, and grounded in the user’s own experience. By talking the user through what they are seeing, ScamFlag does more than prevent a single risky action. It restores their critical thinking at the moment when manipulation is strongest and helps them understand how such scams work, so they can recognize them again in the future. In this way, ScamFlag acts as an always-available fraud specialist.

In behavioral terms, this is the most advanced form of friction. It respects the user’s autonomy while strengthening it, helping them resist emotional pressure and make safer decisions.

Why Smart Friction Is the Future of Responsible UX

With APP fraud now one of the defining challenges of modern fraud prevention, the role of friction needs to be reframed. Friction is no longer the enemy of good design. It has become a hallmark of responsible UX, where safety, transparency, and trust are woven into the experience itself.

This shift is also reflected in the regulatory landscape. Across the world, regulators are increasing scrutiny of scam controls, and smart friction aligns with their expectation that institutions fine-tune their fraud-prevention measures to act reasonably, proactively, and in users’ best interests.

The key to smart friction is balance:

- Frictionless where it can be.

- Protective where it must be.

Backed by behavioral intelligence, device profiling, and AI-driven context, friction shifts from being an inconvenience to becoming a genuine asset. It reassures users that the system is on their side and ready to protect them, even at their most vulnerable moments.

The future of digital trust will not belong to organizations that eliminate friction entirely, but to those that understand its value and apply it with intention.