Why Threatmark

From the first lure to the last dollar. Disrupt fraud every second, at every stage.

AI-powered, holistic fraud prevention for modern banking.

-

10+years of experience.

-

100+team members.

-

9000+phishing sites mitigated annually.

-

40M+online users protected

Be the first to act.

In today’s first climate, financial institutions need to disrupt, not just detect fraud. That means actively breaking attacks apart by dismantling phishing networks, uncovering manipulation in progress, blocking criminal transactions, and shutting down mule accounts.

ThreatMark makes that possible. Our solutions enable banks and credit unions to prevent losses in real-time, protect their entire customer base, and build long-term resilience against an evolving threat landscape.

Counter modern threats with modern tools.

Scams driven by social engineering are surging, and traditional defenses struggles to adapt. By harnessing cutting-edge AI, we help financial institutions transform fraud prevention and keep pace with evolving threat.s

Our technology fuses intelligence from threats, customer behavior, devices, and transactions into a risk-based view of every channel and touchpoint. The result: accurate detection of all fraud types, including APP scams. fewer false positives, and protection that preserves trust without adding friction.

Stay on top of regulations. Lead the industry.

Fraud caused nearly $486 billion in loses in 2023, yet less than 10% represented bank losses. This is changing. Regulatory shifts are placing more liability on financial institutions, exposing them to higher reimbursement costs and greater compliance scrutiny. Staying ahead demands proactive investment in fraud prevention.

With ThreatMark, institutions strengthen compliance readiness through higher fraud detection rates, audit-level visibility into cases, and faster investigations while delivering tangible ROI.

Revolutionize your fraud prevention.

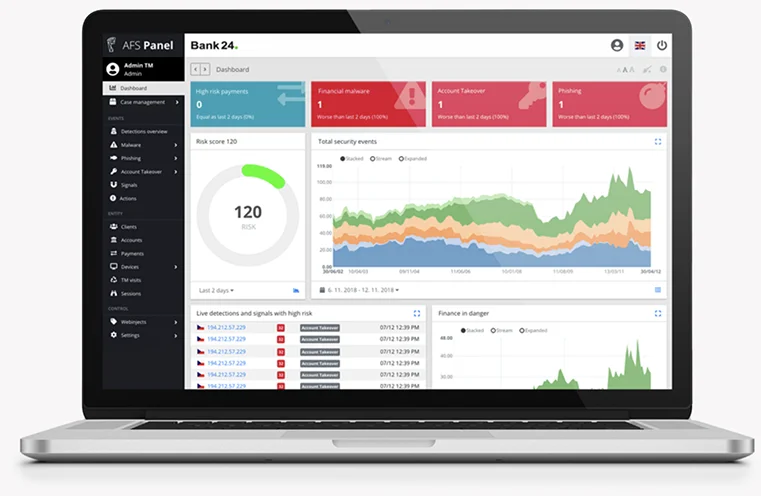

At the core of our approach is the world’s first full-stack fraud prevention platform built on behavioral intelligence, uniting transaction risk analysis, threat detection, and user behavior profiling in a single, integrated system.

learn More

40+ million online users protected. See why.

Partnering with ThreatMark helps your institution deliver secure, trusted online banking. We safeguard banks and customers worldwide, validating over one billion logins and transactions each year.

Explore our success stories

Our investors

Let’s stop fraud together.

Book a 30-minute call to discuss your needs and see how our tailored solutions can protect your institution and your customers.