ThreatMark Listed as a Representative Vendor in Gartner’s Market Guide for Online Fraud Detection

We are thrilled to announce that ThreatMark, a leading provider of a full-fledged banking fraud prevention solution, was selected by Gartner and listed as a Representative Vendor for the Online Fraud Detection area in its Market guide for the year 2020.

Gartner‘s market guides provide valuable information on trends and conditions in specific markets and give professional-grade advice to strategic and IT leaders to assist them with their purchasing decisions. The most recent Market Guide describes the current situation in the online fraud landscape from the standpoint of technology, explores the market, and lists the representative vendors.

“AFS has been used by major banking customers and is protecting more than 20 million end-users all over the world. AFS improves not only anti-fraud capabilities and cost optimization, but it also provides a better and frictionless user experience for the customers. Being mentioned in this Guide proves that ThreatMark’s Anti-Fraud Suite (AFS) is on the right track. Our philosophy, that only a holistic approach is the correct approach in the ever-changing fraud landscape, is perfectly aligned with Gartner’s researchers“ says Michal Tresner, CEO at ThreatMark.

Holistic Solution

The guide points out that the online fraud rapidly evolves, and the traditional transaction-focused solutions had to join forces with proofing and authentication services. Simply checking the payment’s integrity is no longer sufficient Understanding this, ThreatMark devised its own unique approach. “We developed our solution to be innovative, feature-rich, and at the same time, easy to use. We anticipated that the traditional ways of detecting fraud are long gone. That is why we augmented deep behavioral profiling, including behavioral biometrics, together with our transaction and threat detection components.“ says Kryštof Hilar, CTO at ThreatMark.

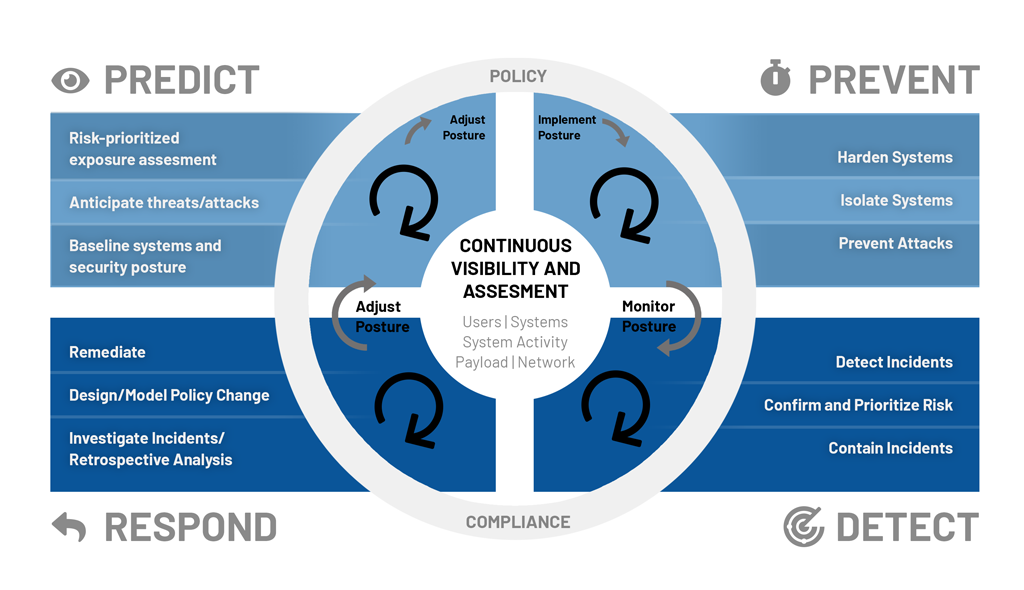

A unique combination of aforementioned components allows ThreatMark’s AFS to detect a multitude of possible risks in digital channels. AFS capabilities far exceed the traditional solutions as besides detecting traditional threats such as client-side malware or information about the fingerprints, it further focuses on the collection and analysis of deep behavior data, such as mouse and swipe movements, typing patterns and interactions with the application unique for each user. Combining evidence-based detection of cyber threats (such as financial malware and phishing), deep device profiling, user behavior profiling including biometrics and transaction analysis all in real-time, the Solution is a perfect fit for a transaction, user and device monitoring, transaction risk analysis, and even for the multi-factor authentication requirements using Inherence set out by the PSD2 RTS. Such a reliable information set can be a perfect base for Continuous Adaptive Risk and Trust Assessment (CARTA) as introduced by Gartner.

All collected information is assessed by a powerful machine learning-based engine. Every user, every item, and every device has its own Risk score associated. The Risk score value depends on the severity of the security issues found. It might be used during the authentication/authorization process or anytime during the customer’s journey to provide an input to the Bank to act upon in real-time.

Prompt Proof of Concept

Further in the paper, Gartner’s analyst comments “Trialing a solution in a POC may be the intention, but the pragmatic reality of integrating vendors and completing contracts — essentially going through the procurement process — just to run a POC becomes a blocker in many cases. In a landscape of similar and competing vendor claims about detection rates and ML prowess, vendor selection presents a challenge.”[1]

To avoids these challenges during POC, ThreatMark invented a unique technique of system integration, which requires close to none of the Client’s resources and significantly reduces the time for POC. At the same time, it does not limit the AFS’ detection capabilities. It allows enabling the Client’s system protection within a fraction of the time of a usual integration. Delivery can be done within a few weeks. Moreover, this fast-paced approach allows you to set up an enhanced behavioral-based security protection system, as stipulated by PSD2 regulation.

“We believe that being named by Gartner as a Representative Vendor reinforces our solution’s value to our customers.“ added Ota Čermák, Head of Sales at ThreatMark.

Gartner’s clients can discover more insights and other recommendations in the report here: Gartner Market Guide for Online Fraud Detection.

Disclaimer

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

[1]Gartner, “Market Guide for Online Fraud Detection,” Akif Khan, Jonathan Care, 13 May 2020.